|

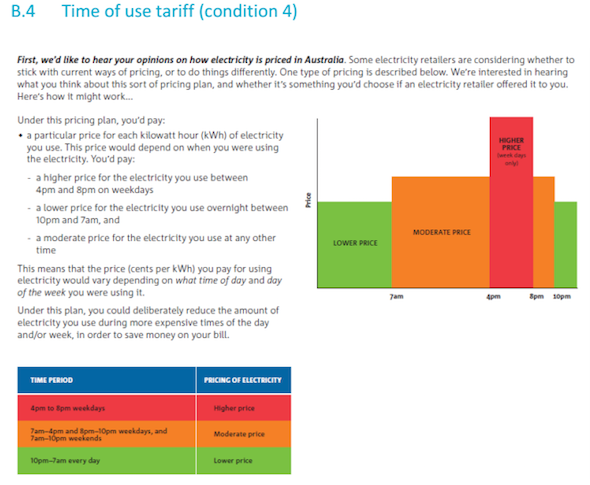

The need for energy industry incumbents to get on board the energy revolution that is rapidly transforming electricity markets around the globe is a well-worn theme. But what about consumers? The inevitable and unstoppable shift to solar and storage is likely to see a big change in the way that tariffs are structured – hopefully for the better, rather than the worse – but it may just mean another level of complexity for consumers in what is already a thoroughly opaque market. As a new report by the CSIRO has pointed out, “meaningful demand-side participation” – which is code for using solar and storage to help manage the grid, such as surges in peak demand – by consumers will be critical to optimising Australia’s future decentralised, distributed electricity systems and stabilising costs. But as this same report also notes, inspiring millions of electricity consumers to “make a substantial and enduring mass shift in electricity usage that flattens peak demand” will be no easy task, particularly when you factor in “the pervasive human preference for simplicity, familiarity and certainty.” And when the key to effecting this mass shift – according to most industry stakeholders – is to get customers to actively uptake cost-reflective or time-of-use energy pricing, and to make the most of it using solar and storage – the task starts to look nigh on impossible. In its survey-based study, Australian Consumers’ Likely Response to Cost-Reflective Electricity Pricing, published on Wednesday, the CSIRO found that “consistent with well-known biases against complexity, novelty and risk …Australian consumers generally prefer flat rate tariffs to all forms of cost-reflective pricing.” “Taking into account those who will never even respond to such a tariff offer, our calculations suggest that the initial voluntary uptake of cost-reflective pricing is unlikely to exceed 5-10% of households,” the report finds.

(In fact, considering 93 per cent of those approached to be surveyed by the CSIRO about cost-reflective electricity pricing gave no response at all, it’s safe to say a clear majority aren’t interested in their electricity tariffs any which way.) And the reason for this, it says, turns out to be pretty simple: consumers have an aversion to making any kind of choice, or to giving up the status quo – a problem, says the report, which is only magnified as the decision-making environment grows more complex. And to be fair to consumers, comparing and contrasting electricity tariffs can be a pretty complex affair – even for self-confessed “energy geeks” like Nigel Morris. “I’m not surprised that most people take a quick look and decide not to sign up,” Morris wrote in 2013. “For all the bluster about trying to incentivise demand savings clearly, my utility could give apparently two hoots. There is NO price signal in this equation that would attract anyone in their right mind after a cursory glance.” Of course, Morris went on to show that TOU did actually save him some money, but not without considerable effort on his part. So what hope for the rest of us? Especially if there’s no discernible cost benefit. It’s a dilemma that was nicely summed up by an Australian network executive at the ENA conference in Sydney earlier this year: it’s not easy to get people interested in making big changes to their energy consumption habits, when it’s a habit that costs them as little as one cup of coffee per day. And of, course, this consumer inertia is pretty convenient for the utilities – as Morris also said: confusion is profit. As long as consumers seem unmotivated to change their energy habits, the pressure is off to change the way energy is delivered. While 1.2 million Australian households have cared enough about rising energy costs – and perhaps the source of their electricity – to install rooftop solar, the CSIRO report suggests that is where energy saving begins and ends, for many. The survey found that homeowners were more likely to invest in once-off energy efficiency measures and expensive home improvements to save energy – including solar installations – than to change their consumption habits. Some of homeowners said they happy just to “keep the current way as we are going solar soon and hopefully get off the grid altogether” – in which case the issue of electricity pricing, cost-reflective or otherwise, was moot. So what is the answer? “Understanding the behavioural elements – how consumers think, feel and act, and why – will play an important role in architecting Australia’s future electricity systems,” the report says. The rest will come down to good policy and regulation – and clever technology: “Together, the insights generated suggest that in order to achieve the desired efficiencies and shared benefits of cost-reflective tariffs, new pricing schemes should be accompanied by a suite of supporting strategies and mechanisms that facilitate both consumer acceptance and ‘appropriate’ demand response. The latter is imperative. “A substantial and enduring mass shift in electricity usage that flattens peak demand seems to require not just isolated tariff reform, but rather tariff reform accompanied by systemic technological changes, especially around automation of usage. “We conclude that in all policy making around cost-reflective pricing it will be absolutely critical to distinguish what might promote uptake as opposed to effective usage of cost-reflective pricing, and to recognise that anything that induces the former without also facilitating the latter might entail considerable political, economic and social risks.” This article has been sourced from Renew Economy

0 Comments

Leave a Reply. |

|

RSS Feed

RSS Feed