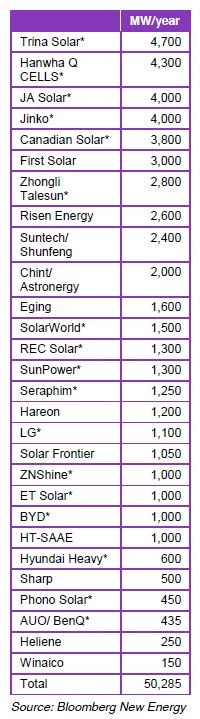

Bloomberg released its Q1, 2016 report recently which showed the changes in brands who are recognized as Tier 1. You can find the list further down below for the Panel Manufacturer's, who made the Tier 1 rating list. However if you wish to find out more about what the Tier System is and how they are rated to meet Tier 1, keep reading below. What is the Tier System, you ask? Bloomberg New Energy Finance PV Module Maker Tiering System Bloomberg New Energy Finance has developed a tiering system for PV module makers based on bankability, to create a transparent differentiation between the hundreds of manufacturers of solar modules on the market. Since this basic categorisation has been used as an advertisement by certain manufacturers, but should never replace a proper due diligence process in product selection, this document explains the tiering criteria and its limitations. 1. WHY DIVIDE THE PV MARKET INTO TIERS? Bloomberg New Energy Finance is frequently requested by clients for a list of 'major' or 'bankable' suppliers - in common industry parlance, tier 1 suppliers - for use in manufacturing forecasts, preliminary competitor analysis, and other internal comparisons. It is very common for industry players to refer to 'tier 1' players, but these terms are seldom defined or described, which is unhelpful for firms outside the solar industry trying to get a basic overview. We strongly recommend that module purchasers and banks do not use this list as a measure of quality, but instead consult a technical due diligence firm such as OST Energy, Sgurr Energy, DNV GL, Black & Veatch, TUV, E3, STS Certified, Clean Energy Associates or Leidos Engineering. These would usually consider what factory the module comes from, as well as the brand, and give an informed opinion on whether the modules will perform as expected. 2. DEFINITIONS 'Bankability' - whether projects using the solar products are likely to be offered non-recourse debt financing by banks - is the key criterion for tiering. Banks, and their technical due diligence providers, are extremely unwilling to disclose their whitelists of acceptable products. Bloomberg New Energy Finance therefore bases its criteria in what deals have been closed in the past, as tracked by our database -13,800 photovoltaic financings worldwide as of January 2016. We reserve the right to change these criteria at any time - particularly by requiring more information to consider a manufacturer tier 1. These tiers will be reviewed every quarter based on information added to Bloomberg New Energy Finance's database. Only project financings for over 1.5MW of capacity are included in the database. Portfolio financings count for tiering only for projects with defined locations, and where the debt is secured on all the assets together, ie, if one project in the portfolio underperforms the bank has a claim on the rest of the portfolio. We only tier manufacturers which actually own production facilities and sell under their own brands. Companies which outsource production under brand names are not tiered. 3. TIER 1 Tier 1 module manufacturers are those which have provided own-brand, own-manufacture products to five different projects, which have been financed non-recourse by five different (non development) banks, in the past two years. These 1.5MW+ deals must be tracked by our database, ie the project location (sufficiently to identify the project uniquely), capacity, developer, bank and module maker must be in the public domain. One exception is manufacturers which have filed for bankruptcy or a form of insolvency protection, or experienced a major default on bond payments; these are removed from the tier 1 list until further notice. This classification is purely a measure of industry acceptance, and there are many documented examples of quality issues or bankruptcy of tier 1 manufacturers. 3.1. Tier 2 We do not publish a tier 2 list. 3.2. Tier 3 We do not publish a tier 3 list. (This is sourced from http://about.bnef.com/content/uploads/sites/4/2012/12/bnef_2012-12-03_PVModuleTiering.pdf) At Driftwind Electrical, we prefer our customers have as much information available to them to make an informed decision before purchasing a solar system. As you can see on our products page, http://www.driftwind.com.au/panels.html Driftwind Electrical recommend many of the Tier 1 panels that are listed in Bloomberg's List below and as advised earlier, this classification is purely a measure of industry acceptance, and there are many documented examples of quality issues or bankruptcy of tier 1 manufacturers. However we also highly recommend Lightway Panels, which do not have a Tier 1 rating but have proven to be a reputable PV Module Manufacturer and you can read further information on the Tiering system here http://www.solarchoice.net.au/blog/what-is-a-tier-1-solar-panel-tier-2-or-3/ Below is the list for the 2016 PV Module Manufacturer's who made the Tier 1 Rating.

0 Comments

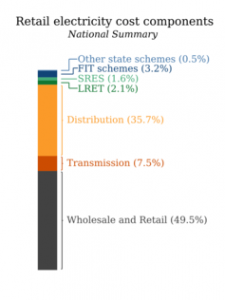

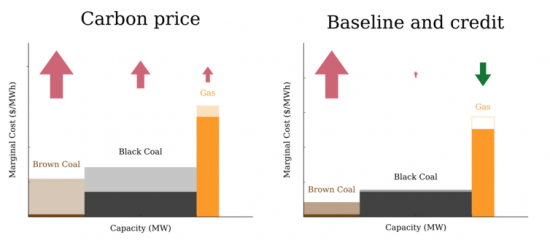

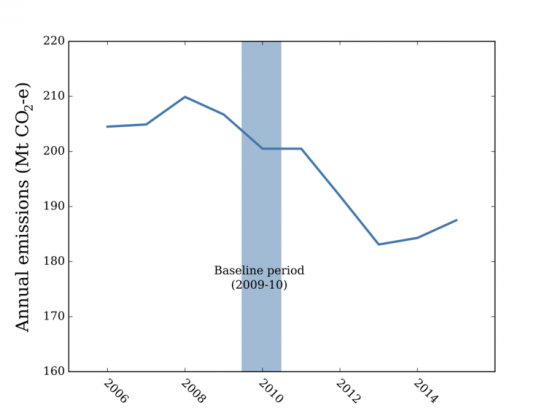

Carbon taxes, emissions trading and electricity prices: making sense of the scare campaigns5/19/2016  National summary of retail electricity cost components – 2015 Residential Electricity Price Trends National summary of retail electricity cost components – 2015 Residential Electricity Price Trends The Conversation Yet again, electricity prices are set to be a key point of contention in an Australian federal election. The Coalition responded quickly to Labor’s election commitment to an emissions trading scheme (ETS), with Prime Minister Malcolm Turnbull warning of “much higher electricity prices” and a “very big burden” on Australians. Other ministers joined in. Treasurer Scott Morrison labelled the plan a “a big thumping electricity tax” and Environment Minister Greg Hunt branded it “Julia Gillard’s carbon tax on steroids”, warning of “even higher electricity prices for Australian families”. The centrepiece of the Coalition’s climate policy, meanwhile, is the A$2.5 billion Emissions Reduction Fund. An important element of this scheme is the “safeguard mechanism”, which is due to kick in on July 1 this year. This has implications for the electricity sector and may also affect electricity prices. National summary of retail electricity cost components – 2015 Residential Electricity Price Trends These policies will affect the wholesale electricity market, in which electricity is bought from power generators and sold on to retailers and consumers. As you can see from the figure to the right, the competitive component of the retail prices makes up about 50% of the typical household electricity bill, and the wholesale component typically makes up half of that. The other major cost is poles and wires. So how exactly will the different climate policies affect electricity prices? The safeguard mechanism (Coalition) The safeguard mechanism will require Australia’s largest emitters to keep emissions below a baseline. This will prevent emissions reductions under the ERF being offset by increases elsewhere. Businesses that go over the baseline will have to pay. The safeguard is based on the high point in annual emissions from the whole electricity sector between 2009-10 and 2013-14. Generators’ individual baselines and associated penalties only come into play if the whole sector goes over the baseline. As you can see in the figure below, emissions have fallen by almost 20 million tonnes per year since the first baseline year (2009-10), partially in response to years of declining demand. Current projections for electricity growth suggest that the baseline won’t be breached for some years. As such, individual generators are unlikely to be penalised, and wholesale prices would not be expected to change dramatically. Electricity sector emissions trading (Labor) Labor’s electricity sector ETS is a “baseline and credit” scheme, based on a model proposed by the Australian Energy Market Commission (AEMC), which actually submitted the proposal to consultation on the safeguard mechanism. This also places a baseline on the electricity sector, but it is calculated on the basis of emissions intensity (tonnes of emissions per unit of electricity generated) rather than overall emissions. Generators with emissions intensity below the baseline (for example, gas generators) would earn credit, so “cleaner” power plants would generate more credits. Power plants that go over the baseline (for example, brown coal) would have to buy credits for the amount they go over. “Dirtier” plants would thus have to buy more credits. This is substantially different to a carbon tax or the previous emissions trading scheme. Under these policies, all generators are penalised, some more than others, as you can see in the figure below. Current projections for electricity growth suggest that the baseline won’t be breached for some years. As such, individual generators are unlikely to be penalised, and wholesale prices would not be expected to change dramatically. Electricity sector emissions trading (Labor) Labor’s electricity sector ETS is a “baseline and credit” scheme, based on a model proposed by the Australian Energy Market Commission (AEMC), which actually submitted the proposal to consultation on the safeguard mechanism. This also places a baseline on the electricity sector, but it is calculated on the basis of emissions intensity (tonnes of emissions per unit of electricity generated) rather than overall emissions. Generators with emissions intensity below the baseline (for example, gas generators) would earn credit, so “cleaner” power plants would generate more credits. Power plants that go over the baseline (for example, brown coal) would have to buy credits for the amount they go over. “Dirtier” plants would thus have to buy more credits. This is substantially different to a carbon tax or the previous emissions trading scheme. Under these policies, all generators are penalised, some more than others, as you can see in the figure below.  Impact of carbon price and baseline and credit scheme on different generation technology in the electricity sector. A carbon prices increases all prices, relative to emissions intensity. A baseline and credit scheme increases the price of high-emissions-intensity generation, but lowers the price of low-emissions-intensity generation. This difference is important for electricity prices. Dirtier plants would be expected to increase their selling price to cover the financial penalty on their emissions. But cleaner plants, earning revenue from selling credits, could afford to sell their electricity more cheaply.

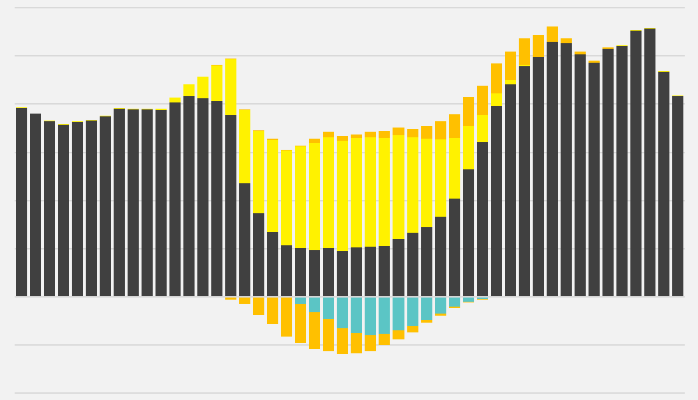

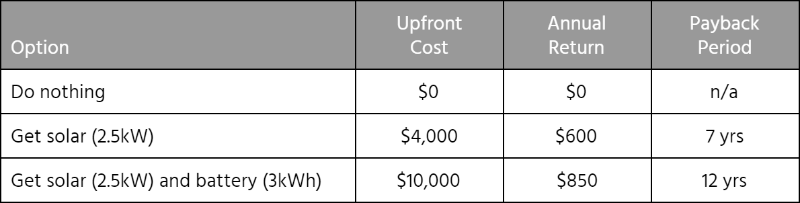

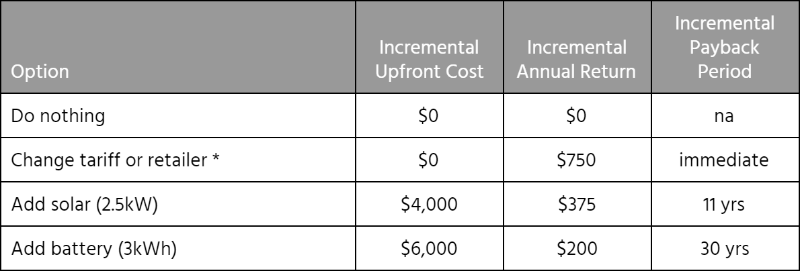

This is important, because cleaner plants (typically black coal or gas) set the price. Gas in particular would probably be significantly cheaper under this proposal. As such, the impact on wholesale prices would be small, or negative. In fact, as the AEMC itself noted, the impact on the wholesale market could be an increase or decrease in prices (depending on where the baseline is set). The brown coal exit (Labor) Another component of Labor’s climate platform is a plan to finance the closure of brown coal power stations, an idea first proposed by ANU climate economists Frank Jotzo and Salim Mazouz. In this proposal, brown coal plants would bid for the payment they would require to finance their own shutdown, with the cheapest bid being selected. The remaining plants would pay this cost, in line with their emissions. Similar to the ETS, it would be expected that this cost would be reflected in increased offer prices to the market from the remaining generators. The direct costs would be temporary (a one-off payment) and small, relative to the overall wholesale price. Indeed, Jotzo and Mazouz estimated it could cause a one-off rise of 1-2% in retail power bills. Analysis company Reputex found the impact could be between 0.2% and 1.3%. However, Danny Price of Frontier Economics has suggested that the scheme could push up retail power prices by between 8% and 25%, as the result of a short-term price shock. But given the significant excess capacity in the market, and assuming that the market is indeed competitive, it is hard to see how such a increase would happen. This point aside, the price argument misses the point of the scheme, which aims to deliver an “orderly transition” away from brown coal. The longer-term effects on supply and price of a brown coal exit will be similar, regardless of how the industry closes. In fact, if it were left entirely to the market, the sudden retirement of an entire power plant might create even more of shock. This proposal is chiefly about ensuring an orderly, predictable transition. 50% renewable energy target (Labor) The final element of Labor’s climate platform is a 50% renewable energy target by 2030. At this stage, not much detail has been unveiled other than shadow environment minister Mark Butler’s pledge that it will be “designed in a way that does not disturb investor sentiment around the delivery of the existing Renewable Energy Target” – something that a sector beset by uncertainty would welcome. As such, it is quite difficult to speculate on how electricity prices might react. The current Renewable Energy Target is a certificate scheme that requires retailers to buy a certain amount of renewable energy. The cost of these certificates is passed on through electricity bills. However, as shown by the government’s own modelling, the interaction with the wholesale market results in a net saving to consumers.Interestingly, and as the AEMC points out, the electricity ETS is designed to be flexible and integrate with a renewable energy target. Indeed, such an ETS could drive investment in renewable energy, replacing current subsidies through the Renewable Energy Target. The 50% target could theoretically be achieved through the ETS alone, if the baseline was set at the right level. A bipartisan approach? As it stands, the government’s climate platform is unlikely to have any impact on electricity prices. However, it will also not have a major impact on the electricity sector’s emissions. Labor’s policies will have an impact, but as the AEMC notes it may occur “without a significant effect on absolute price levels faced by consumers”. The government’s current polices will require strengthening to further reduce emissions. To achieve this, the Grattan Institute and others including the Business Council of Australia have supported ideas that would turn the Liberal platform into something very similar to Labor’s. Indeed, modelling commissioned by the government itself assumes that Direct Action will eventually morph into a similar baseline-and-credit ETS, in order to meet long-term climate commitments. Political slogans aside, perhaps a bipartisan approach is possible, without a significant effect on power bills. Dylan McConnel: Research Fellow, Melbourne Energy Institute, University of Melbourne. He received funding from the AEMC’s consumer advocacy panel. This article is sourced from Renew Economy. You can read the original article here Interest in energy storage is heating up across Australia, and thanks mainly to Tesla’s Elon Musk, the prospect of installing a battery at your home and having it provide power to your household equipment has become fashionable.Beyond the hype, there are a number of factors that are driving consumer-level interest in batteries, namely high retail electricity prices, the large gap between peak prices and off peak prices, the high penetration of solar coupled with the low feed-in tariffs offered by retailers, and an instinctive feeling that the big electricity utilities are not on your side. Getting solar PV and a battery seems like the logical response to reduce electricity bills and loosen the grip of the grid, and the retailers that have been profiting from your escalating energy bills. However, let’s remove the emotion for a minute and take a close look at the economics of the decision whether or not to get a solar PV and battery system. The key mistake that many people make is to treat this as an all or nothing decision. The nothing option is easy — resigned to the view that your electricity bills are all too boring and complex to do anything about, combined with the likelihood that you don’t know who to trust — you simply do nothing. On the other hand the all option involves purchasing a large solar PV system and a battery to generate, store and use as much of your own electricity as possible. (For example, at today’s prices a 5kW solar PV system and a 12kWh battery might cost about $20,000 and a smaller 2.5kW solar PV system and 3kWh battery might cost about $10,000.) You would think that an experienced installer or your electricity retailer would know what kind of savings these systems will generate but the reality is nobody can tell you with sufficient certainty. There are so many variables to take into account, including the crucial element of exactly how you as a consumer use electricity throughout the day and across the seasons. Your retailer might have some insight into this if you have a digital interval meter, or smart meter, but they are not using this information to figure out what your savings could be. And considering that they make more money when you consume more from the grid they really have no incentive to help you cut your grid consumption. The fact is that right now the typical payback period for energy storage can be as high as 30 years, and given that most decent battery systems come with a 10-year warranty, and power converters probably last about this long too, you’d be right to conclude that a payback period in excess of 10 years is a poor financial outcome. The mistake though is to treat this as an all or nothing decision, instead of taking an incremental approach to the analysis. There are some simple things that you can do today to cut your electricity bill, but beyond these simple, low investment options, you also need to decouple solar from storage because put simply, solar is relatively cheap and proven technology, whereas storage is expensive and nascent. There is no logical reason that you have to do the two together, and separating the two and running the numbers proves this. Sellers of solar and storage equipment will typically look at your current bill and situation and compare this against the scenario where you install a solar PV system and possibly also a battery storage system that will store excess solar generation and supply this to your home during peak times. To keep the economics simple we’ll just focus the simple payback period, that is, how many years it will take to pay back your investment. (Although this is not the most robust way to analyse investment decisions, it is the simplest metric to look at, and the one most commonly used to compare and express the economic benefits of these systems.) Absolute Approach The “absolute approach” compares the result of doing something to the current state, that is, “buy system X or do nothing”. The table above shows that it seems to make good sense to get solar, as an investment of $4,000 provides savings of $600 each year, and you’ll make your money back in just under 7 years. Getting solar and storage together is not as good though, since an investment of $10,000 saves you $850 each year, and you only make your money back in 12 years. Personally I feel like a 12-year payback period is a little too long, but I’ll leave it to you to decide whether you’d just go for solar or get solar and storage at the same time. The problem though is that this analysis is fundamentally flawed for 2 key reasons. The first issue is that adding a battery should be looked at incrementally. The battery adds $6,000 on top of the solar system and returns an additional $250 each year ($850 less $600), for a payback period of 25 years. Looked at in this way you would be right not to get the battery system. The mistake in the analysis above is that it looks at decisions in an all or nothing way, when in fact you need to look at each decision incrementally. The second problem is that this analysis misses a key opportunity, and that is, you can easily, and generally for no upfront cost, save money by first switching to a better electricity tariff either from your current retailer or a new retailer * that offers a better tariff for your level of usage. For example, in New South Wales, the government website Energy Made Easy compares all available tariffs against one another and shows you how much you could save by switching. Switching generally costs nothing, and for our example household, can deliver large savings. Incremental Approach Adding in the option of switching tariffs and then taking an ‘incremental approach” to the analysis shows us that switching tariffs or retailer * can save $750 each year. After doing this, even getting solar looks like a borderline decision, and adding storage is definitely out of the question for now.

This appears to be bad news for solar and storage, but that is not the point. The point is what is good for consumers is to first take advantage of low cost and easy ways to save money on energy. The next step is to gather good data about how you use energy and work with someone you trust to give you the right advice, specific to your circumstances. The final step is to possibly invest in solar and storage technology to help you further reduce your bills and reliance on the grid. For most people with average to high electricity bills, and good north or west facing roof space, solar will make sense today. However, storage is still too expensive for the mainstream consumer who wants to cut their energy bills. But all of this will change as battery costs continue to come down, the technology improves, additional revenue streams for the battery become apparent, and grid prices continue to rise. Article by Darren Miller Darren Miller is Co-Founder & CFO at Mojo Power. Article sourced from One Step Off the Grid |

|

RSS Feed

RSS Feed